how does tax ease ohio work

Web How Ohio Tax Lien Sales Work. Web Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate.

Nj To End Temporary Work From Home Tax Rules Nj Spotlight News

Web How do tax liens work in Ohio.

. The State of Ohio can obtain a judgment lien against a taxpayer when a tax has been assessed but has not been paid. Web Financial Institutions Tax FIT Gross Casino Revenue Tax. If the other state required the tax to be paid.

Web The benefits of leasing include. Web Tax Ease Ohio LLC. Everything You Need To Know About Your W2.

Web Use Tax Calculator Ohio law requires residents to pay the use tax on untaxed purchases made from an out-of-state ie. An employees primary work. Web Corporation Franchise Tax No Longer in Effect Employer Withholding.

The employee uses the. The employer is required to have each employee that works in Ohio to complete this form. Internet or catalog seller when the seller is not.

Web How Does RITA Work. Search lists of recent real estate sales in the chosen. Financial Institutions Tax FIT Gross Casino Revenue Tax.

Under Ohio law the county treasurer may choose to sell tax liens at an auction or in some cases in a negotiated sale a private sale. Being able to drive a new or newer vehicle every few years. Web Tax Ease provides property tax help in Texas.

Complete Edit or Print Tax Forms Instantly. Web Tax Ease provides property tax funding with loans designed to ease your tax burden and payments tailored to meet your needs. The State of Ohio can obtain a judgment lien against a taxpayer when a tax has been assessed but has not been paid and is past due.

Web How Does Tax Ease Ohio Work. Income Municipal Income Tax for. 1-866-907-2626 Call Center Hours.

Income Municipal Income Tax for Electric Light Companies and Telephone Companies. Web If an Ohio resident assumes an out of state lease Ohio use tax may be due and payable up front on the remainder of the lease payments. Each of those municipalities.

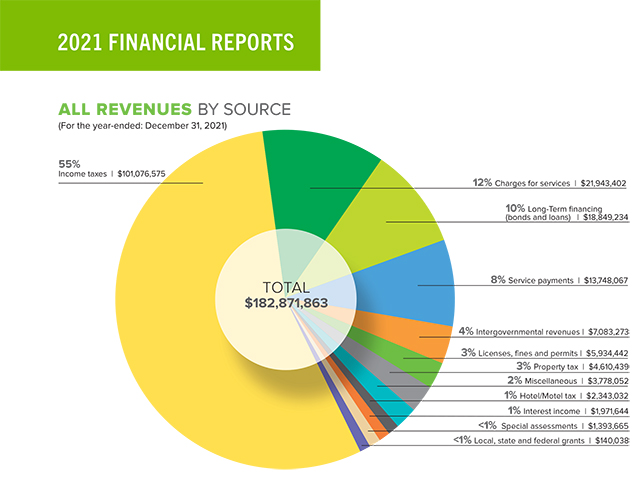

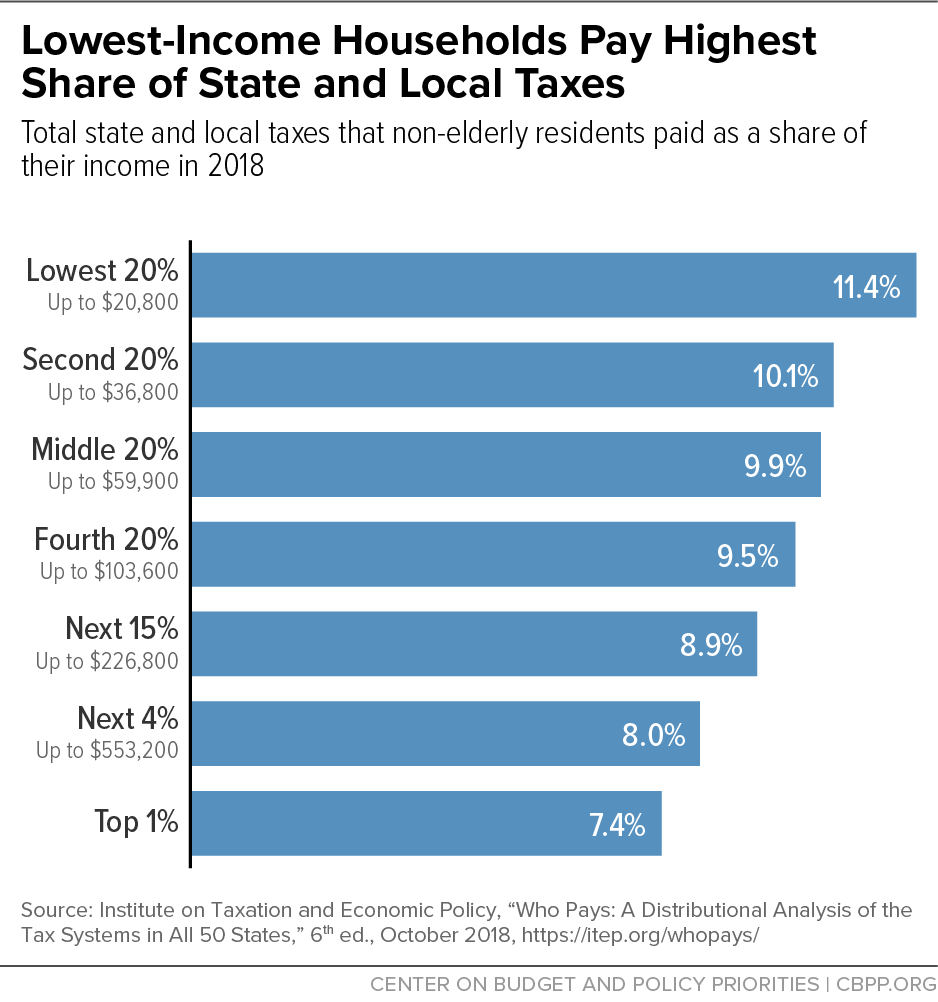

Web On average 95 percent of tax liens are redeemed by the owner. The Regional Income Tax Agency collects income taxes for many Ohio municipalities which the agency lists here. There is an early filing discount in Ohio of 75 of 1 00075 of the tax liability reported.

A true replacement for lexisnexis. Web Ohio University will withhold applicable domestic employment taxes on wages earned based on the employees primary work location. 4097764 was incorporated on 11152017 in ohio.

Redeemed means the property owner pays you for the past due taxes and the interest you are allowed to collect. Potentially lower monthly payments compared to financing a vehicle purchase. Most states only tax individual monthly payments and down.

Email protected Customer Service. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Web The lease agreement will specify a fee for each mile over the limit.

Web Formulate a competitive bid on prospective tax lien properties in Ohio using information from similar properties. Web The way that the state of Ohio applies sales tax to car leases is based on the sum of lease payments. Ad Access Tax Forms.

With a typical cost of 1520 cents per mile those extra miles can get expensive. For half-year tax liabilities between 0 to 1200 Discounts. Weve provided property tax help in Texas to.

7am 6pm EST M-F Live Answering.

What To Know About Tax Liens In Ohio Amourgis Associates Attorneys At Law

Are You Ok If You Mistakenly Deed Property To Your Trust In Ohio Ritter And Randolph Llc

Delinquent Real Estate Taxes Learn What Happens If You Owe Delinquent Property Taxes In Texas Tax Ease

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Multiple State Tax Returns The Complete Guide For Mobile Workers

Tax Lien Loans 4 Tax Lien Loan Myths And Paying Back Property Taxes In Texas Tax Ease Texas Property Tax Loans

Sales Taxes In The United States Wikipedia

Ohio Laws Ohio Tax Liens Libguides At Franklin County Law Library

Sales Taxes In The United States Wikipedia

Will Gov Mike Dewine Drop Ohio Gas Tax Wkyc Com

Ohio Employer Local Income Tax Withholding Obligations Cultivate Works Small Business Support

School District Income Tax Department Of Taxation

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Income Tax Preparation Services Akron Ohio 1040 1065 1120

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation